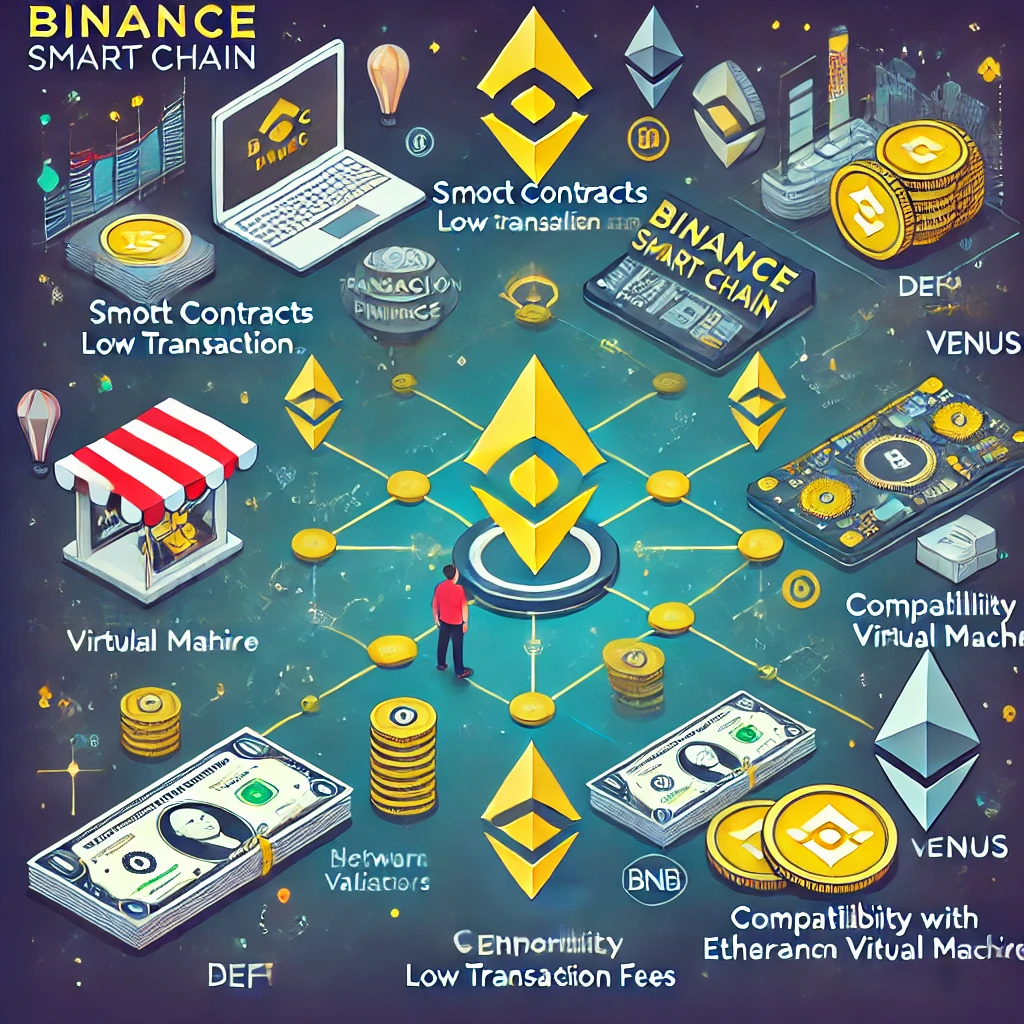

Binance Smart Chain: Features, DeFi, and Ecosystem Overview

In the blockchain world, Binance Smart Chain (BSC) has become a dominant force, especially in decentralized finance (DeFi) and decentralized applications (DApps).

With its low transaction fees, fast block times, and compatibility with Ethereum, BSC has gained popularity among developers and users alike.

In this overview, we’ll delve into the key features of Binance Smart Chain, explore its role in DeFi, compare it to Ethereum, and look at the top DApps and projects shaping its ecosystem.

1. Introduction to Binance Smart Chain (BSC):

Binance developed BSC (Binance Smart Chain) to support high-throughput smart contracts and decentralized applications (DApps) with low fees.

It operates alongside Binance Chain, focusing on decentralized finance (DeFi) and the growing DApp ecosystem.

2. How Binance Smart Chain is Fueling DeFi Growth:

BSC is fueling DeFi with popular projects like PancakeSwap (a decentralized exchange) and Venus (a money market). Its low fees and fast transaction speeds make it a preferred choice over Ethereum for many DeFi developers and users.

3. Binance Smart Chain vs Ethereum:

Binance Smart Chain, launched by Binance in September 2020, is a blockchain designed to support smart contracts and decentralized applications (DApps) while offering fast, cheap transactions.

It runs parallel to Binance Chain, the first blockchain created by Binance, which focuses on speed and scalability for trading assets but doesn’t support smart contracts.

The main advantage of Binance Smart Chain lies in its ability to bring together the best of two worlds: fast transactions and low costs.

Its primary aim is to offer an efficient environment for building decentralized applications (DApps), participating in decentralized finance (DeFi), and running tokenized projects.

It is often considered a more affordable and faster alternative to Ethereum, especially during times of high network congestion.

4. Top DApps and Projects on Binance Smart Chain:

Popular DApps include PancakeSwap (DEX), Venus (lending), and Autofarm (yield aggregator). These projects thrive on BSC’s cost-effective and high-performance infrastructure.

5. How to Build a DApp on Binance Smart Chain:

Developers can easily deploy decentralized apps using Ethereum-compatible tools such as Remix and Truffle. The BSC also supports MetaMask, making it accessible to users familiar with Ethereum DApps.

6. Binance Smart Chain vs Ethereum:

BSC has often been compared to Ethereum due to their similar functionalities, but there are several key differences between the two:

EVM Compatibility: Both Ethereum and Binance Smart Chain are compatible with the Ethereum Virtual Machine (EVM), allowing developers to easily port their applications between the two networks.

However, BSC’s lower fees and faster speeds have made it an attractive alternative for projects that initially launched on Ethereum.

Transaction Costs: One of the biggest advantages BSC has over Ethereum is its significantly lower transaction fees. While Ethereum gas fees can skyrocket during periods of high demand, BSC offers a more affordable alternative, with fees often remaining under $1 per transaction.

Transaction Speed: BSC’s 3-second block times are much faster than Ethereum’s average block times of 13 seconds. This makes BSC more suitable for applications that require fast transaction finality, such as decentralized exchanges and gaming DApps.

Decentralization: One of the criticisms of Binance Smart Chain is its relative lack of decentralization. While Ethereum has thousands of nodes securing its network, BSC has a smaller number of validators (21 at any given time), which are selected based on the amount of BNB staked. This gives Binance more control over the network compared to Ethereum, where anyone can run a node and participate in consensus.

7. Security and Risks on Binance Smart Chain:

While Binance Smart Chain offers many benefits, it is not without risks. The rapid growth of DeFi on BSC has attracted malicious actors, and several high-profile hacks and rug pulls have occurred on the platform. Some of the risks associated with BSC include:

Rug Pulls: Rug pulls occur when a project’s developers abruptly remove liquidity from their token pools, leaving investors with worthless tokens. This has been a frequent issue on Binance Smart Chain, particularly in the early days of its DeFi ecosystem.

Smart Contract Vulnerabilities: Hackers can exploit vulnerabilities in smart contracts on the BSC blockchain, just like with any other blockchain. It is essential for projects to undergo thorough audits by reputable security firms like CertiK or PeckShield before launching.

8. Binance Smart Chain and NFT Marketplaces:

BSC hosts NFT platforms such as BakerySwap and Binance NFT Marketplace. These platforms offer low fees, allowing artists and collectors to trade NFTs more affordably compared to Ethereum-based alternatives.

9. The Centralization Debate:

One of the criticisms of Binance Smart Chain is its relative lack of decentralization. While Ethereum has thousands of nodes securing its network, BSC has a smaller number of validators (21 at any given time), which are selected based on the amount of BNB staked.

This gives Binance more control over the network compared to Ethereum, where anyone can run a node and participate in consensus.

10. The Role of Binance Coin (BNB):

BNB is used to pay for transactions and as a staking asset in BSC’s validator system. It also powers DeFi, lending, and governance protocols within the ecosystem.

You can use the infographic to better understand BSC’s key features, such as its DeFi and DApp ecosystem, its low fees, and its integration with Ethereum.

Conclusion:

Binance Smart Chain has rapidly emerged as one of the leading blockchain networks for decentralized finance and decentralized applications.

Its low fees, fast transactions, and compatibility with Ethereum have made it an attractive alternative to Ethereum for developers and users alike.

However, the centralization concerns and security risks highlight that while BSC offers many advantages, it is still important for users to be cautious and conduct thorough research before engaging with any DeFi projects on the platform.

Post Comment